Table of Contents

One of the biggest shifts in how I bet over the last year is where I place my action.

Instead of living on the usual FanDuel/DraftKings carousel, most of my handle now runs through exchanges and prediction markets.

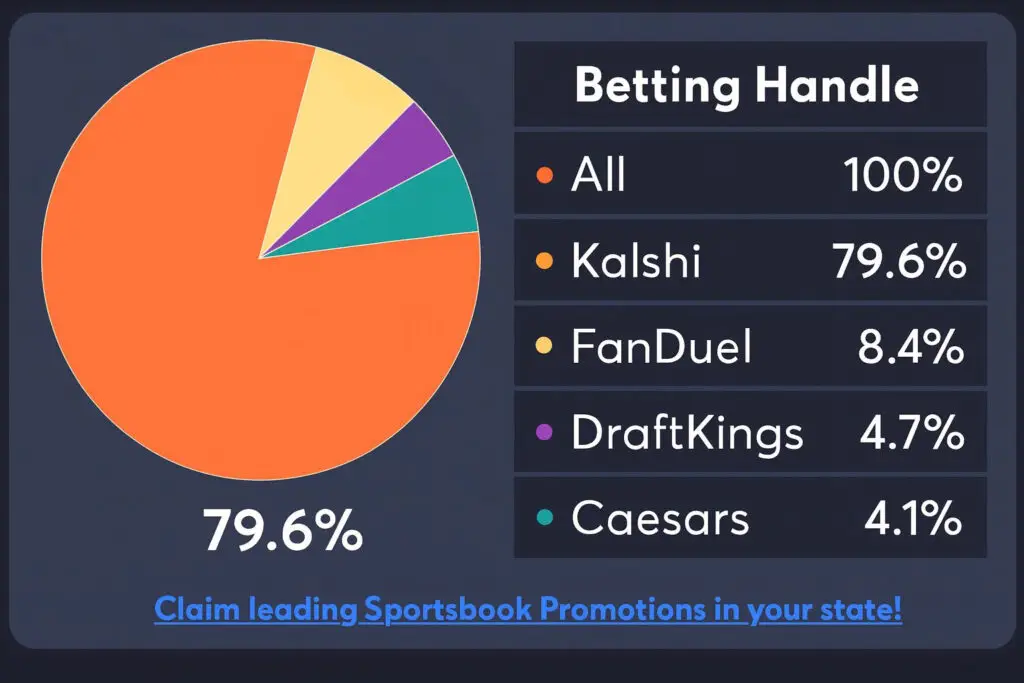

80% of my handle is on Kalshi this year, which now syncs to Juice Reel!

With Kalshi live nationwide and Polymarket launching in the U.S. by the end of November, it’s a good time to get fluent in how these platforms differ from traditional sportsbooks.

Most bettors still only know the “retail-book” experience. So this week I’m kicking off a multi-part series on exchanges (or prediction markets) vs sportsbooks — what changes, what stays the same, and how to get maximum value by leveraging exchanges in the right situations.

In each part, (including today), we’ll build a Bet of the Week using one of these platforms.

Let’s get after it.

Prediction Markets are Not Betting Against the House

The biggest distinction between exchanges and retail books: who’s on the other side of your bet and how it’s priced.

On a traditional “retail” sportsbook:

When you open FanDuel, DraftKings, BetMGM, etc.:

Your counterparty is the house.

If you bet $110 on -110 and lose, they keep your $110. If you win, they pay you $100.They set the line.

You don’t see an order book; you just see one price for a given side: “-3.5, -110” and choose your stake.You get an instant fill (inside their limits).

If the bet is offered and you’re under your personal limit (which can be quite low for winning bettors), they accept it immediately — no other customer has to agree.

Think of it as a store shelf: the book posts one price for each bet, you decide whether to buy.

FanDuel will let you bet the Bills to win at -270

On an exchange / prediction market

On a prediction market or exchange (Kalshi, ProphetX, NoVig, Polymarket):

Your counterparty is another user.

The platform is mostly a matching engine + rulebook, not the house taking every opposite side.Prices come from bids and asks.

You’ll often see markets framed as YES/NO shares between $0 and $1 (or 0–100%), where the price trading is the market’s current belief about the probability.Your bet or “fill” depends on other users’ orders.

You can approach betting in two ways:Hit an existing offer (like taking an ask in a stock). This is similar to betting with FanDuel and you’ll have a bet down right away.

Or post your own price and wait for someone to trade with you. You’ll only have a bet if someone else acts, but you can choose a price you’re happy with.

This is Kalshi’s order book for the same moneyline bet

So: sportsbook = you vs house, fixed menu of prices.

Exchange = you vs crowd, live order book to buy now or offer a price you like.

We’ll lean on that mental model the rest of the series.

Converting Moneylines ↔ Implied Probability

The next important difference between a sportsbook and an exchange is how they show pricing.

Sportsbooks use moneylines, whereas prediction markets use implied probability.

Moneylines themselves aren’t intuitive.

A moneyline that starts with a minus sign denotes the amount a bettor would need to wager to win $100.

So if the line is -200, you bet $200 to win $100.

A moneyline preceded by a plus sign denotes the amount a bettor would win if wagering $100.

So if the line is +200, you bet $100 to win $200.

In contrast to moneylines, implied probability percentages are intuitive.

They tell you exactly how often a team needs to win, or a player needs to hit a milestone, for a bet to be profitable long term.

To price shop between retail books and exchanges, we’ll need to 1) convert everything to probabilities and 2) understand any additional fees charged by exchanges.

Here’s the basic math on converting moneylines to implied probability.

Moneyline → implied probability

Formulas:

For negative odds (favorite, e.g. -150):

Implied probability = |odds| / (|odds| + 100)For positive odds (dog, e.g. +200):

Implied probability = 100 / (odds + 100)

Examples:

-150 favorite

Probability = 150 / (150 + 100)

150 / 250 = 0.60 → 60%

+200 underdog

Probability = 100 / (200 + 100)

100 / 300 ≈ 0.33 → 33%

On many exchanges, it’s even simpler:

A YES share at $0.63 literally implies a 63% chance.

A NO share at $0.37 implies 37%.

Example Using Thursday Night Football

Let’s use the approach to compare Kalshi’s price on the Bills to win tonight vs FanDuel’s price:

FanDuel is offering -270. Using the formula above, we’d calculate:

270 / (270 + 100) = ~73%

Kalshi’s order book showed the ability to “buy” right now at $0.72 (or 72%) or place an order someone else could “fill” at $0.71 (or 71%).

If there were no fees attached, both of those prices would be clearly better than FanDuel’s offer because 73% > 72% (or 71%).

We’ll get to Kalshi’s fees in a later part of this series, but for now, know that you’ll pay more on an exchange to “buy now” (this is called being a “taker”), and so Kalshi’s 72% plus fees is actually worse than FanDuel’s -270.

Putting an offer in and getting filled at 71% on Kalshi, however (this is called being a “maker”), would offer lower fees and the best price, more attractive than FanDuel’s -270.

The biggest tradeoff with the “maker” approach — you run the risk of never getting your bet down. We’ll talk strategy on this front in a future edition.

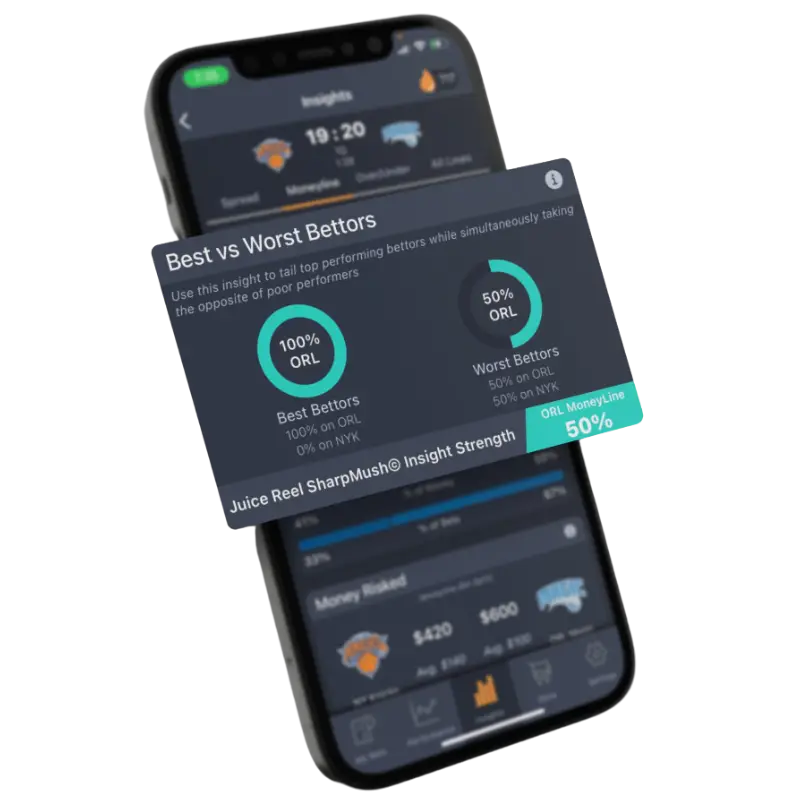

Juice Reel provides an easy way to line-shop retail books against exchange “taker” or “buy now” prices.

The dropdown menu with all prices includes exchange fees, which does the trickiest part of this for you.

Kalshi’s $0.72 price + fees comes out to a -276 moneyline

This calculator won’t shop lines, but can also be a great hack to convert moneylines and percentages back and forth.

In conclusion the two biggest differences that show up in exchanges are:

Who you’re betting against and how price is determined, and —

The way pricing is communicated — with moneylines or with implied probability.

Next up in Part 2, we’ll dig into liquidity, incentives, unique two-sided markets, and treatment of winners, as we continue learning about exchanges and their differences from traditional books.

Now let’s make some bets!

Explore More Betting Insights!

Have you tried the Juice Reel app? Besides the fact that it’s free to use, here are some of the features you’ll find in the app:

- Daily AI sports picks from our AI sports betting bot

- Community betting trends and consensus picks

- AI player prop bet predictions for every game so you can find the best PrizePicks today

- Best odds across 300+ sports books (onshore & offshore)

- Automatic bet syncing across all your sports book bets

- Live bet tracker (like a stock portfolio ticker)

- Sell your sports picks and find the best sports handicappers

Our website is great, but our app is better. The website is just a preview of what you can find in the free mobile app. Just the tip of the iceberg.

Download the free AI Sports betting app now to access all the sports betting data you can dream of. There is a reason Juice Reel has been crowned the “best sports betting tool”. Find out for yourself by clicking the button below.